IMF predicts 1% GDP growth for Portugal in 2023

The latest World Economic Outlook - WEO released in early April by the IMF - International Monetary Fund reveals that there has been a positive upward revision in the projected GDP growth for 2023. The IMF's economists now expect the national GDP to grow by 1% this year, indicating an improvement from their earlier forecast of 0.7% growth in October last year.

Despite the slight improvement in GDP growth projections, the figure of 1% falls short of the latest forecasts made by the Bank of Portugal, which indicate a more optimistic growth rate of 1.8% for 2023. Additionally, the Government's projection of 1.3% growth, as outlined in the State Budget for 2023, is also higher than the IMF's estimate.

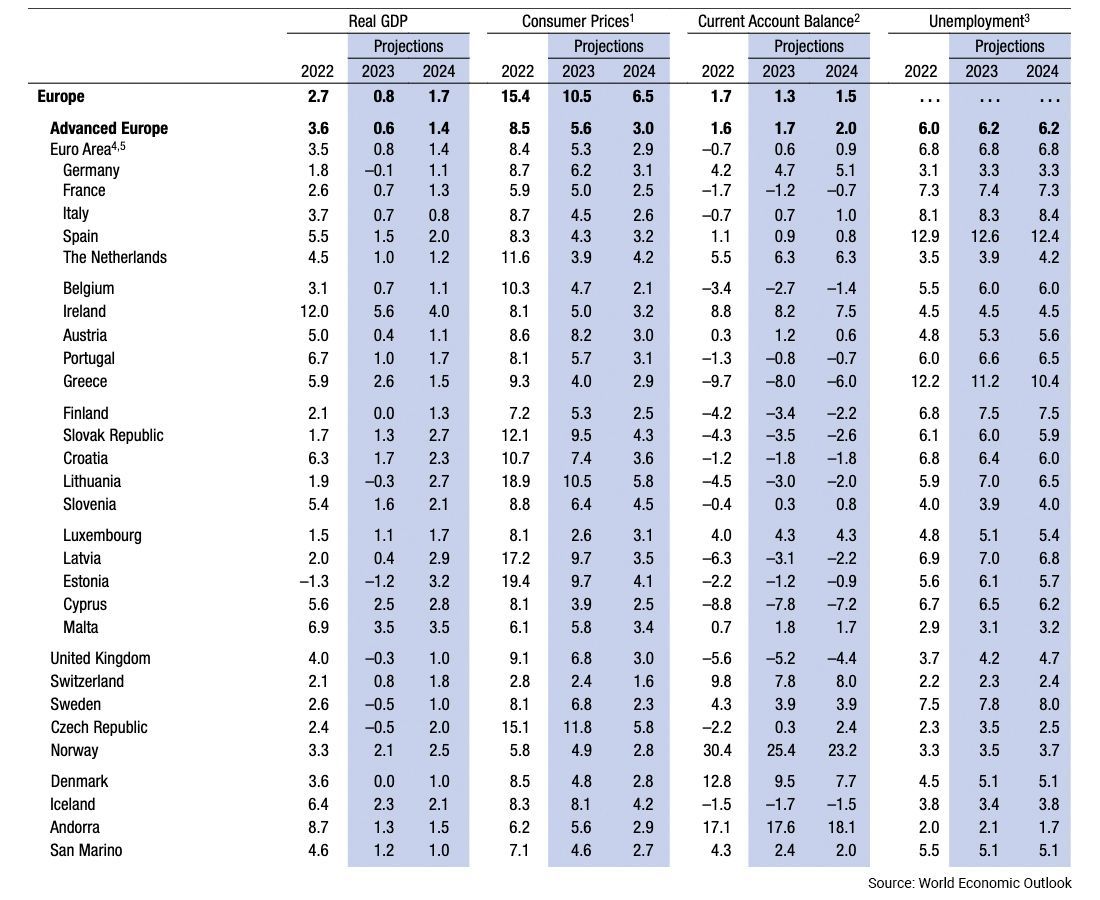

Should the IMF's projections come to fruition, Portugal will outpace the average GDP growth rate of 0.8% across the 20 nations in the Eurozone. In fact, Portugal will be ranked as the 10th fastest-growing economy in the currency bloc, alongside the Netherlands. The top spot for GDP growth is occupied by Ireland, with a projected rate of 5.6%, while Estonia, Lithuania, and Germany are expected to experience negative growth rates of -1.2%, -0.3%, and -0.1% respectively.

While the IMF's projections for Portugal's GDP growth have improved, the same cannot be said for other economic indicators. The April WEO report suggests that Portugal's current account deficit is expected to deteriorate from 0.4% of GDP to 0.8% of GDP. Additionally, the unemployment rate is projected to rise to 6.6% this year, which is a slight increase from the 6.5% estimated by the IMF's economists in October last year.

The IMF's latest projections suggest that the most significant downgrade in the forecast for the Portuguese economy is in the area of consumer prices. Despite the expectation for a deceleration in inflation, the Fund now anticipates an average inflation rate of 5.7% for this year. This is a notable increase from the 4.7% estimate made by the IMF in October last year.

It is worth noting that the IMF's upward revision of inflation for 2023 is not limited to Portugal alone. The latest projections for the Eurozone indicate an inflation rate of 5.3% in 2023, which is a 0.6 percentage point increase from the IMF's earlier forecast in October.

Likewise, the IMF's revised inflation projections for Portugal are consistent with its latest estimates for the global economy. In January, the Fund's economists had forecast an average inflation rate of 6.6%, which has since been revised upwards to 7%. Despite this upward revision, the IMF still expects a decrease in the inflation rate compared to 2022, as it does for the Eurozone.

According to the IMF's April WEO report, disinflation is anticipated across all major country groupings. Approximately 76% of economies worldwide are projected to experience a decrease in inflation in 2023 compared to the previous year.

Source: Eco